salt tax repeal new york

The push backed by Gov. Many states have recently enacted SALT cap workarounds to protect taxpayers.

New Salt Proposal Raises Cap To 80k Queenswide Qchron Com

The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before. New York state on Monday made another attempt to overturn the 10000 cap on state and local tax deductions amid broader efforts in Congress to raise the ceiling and undo part of a 2017 tax law. New York seeks Supreme Court review of SALT cap.

Bidens DOJ is trying to preserve the. Cuomo said that taxes on New Yorkers would actually go down if federal lawmakers repeal the 10000 cap for deducting state and local taxes known as SALT. New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap.

New York is taking another run at repealing SALT cap. It would maintain the so-called SALT cap on deductions for taxpayers earning more than 100 million per year and direct the saved money to. House Democrats from New York on Tuesday escalated their push for the repeal of the cap on the state and local tax deduction threatening to oppose future tax legislation that doesnt fully undo.

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less Share this post. The push backed by Gov. Salt tax repeal new york Wednesday March 9 2022 Edit.

Before Trump capped the deductions residents of high-tax states like New York could deduct their local state and. They wont really count when the 10000 cap on state and local tax deductions is repealed by Congress. Recently NYSAC sent a letter.

But its not entirely clear when or if that cap put in place as part of the 2017 federal tax law will actually be thrown in the wastebin by the narrow Democratic majorities in Congress. A pair of House Democrats have sponsored legislation that would restore the state and local tax SALT deduction for Americans who make under 400000. That law the Tax Cuts and Jobs Act of 2017 did cut taxes for some but increased taxes on many not rich homeowners in certain states notably New York where it costs people an extra 12 billion.

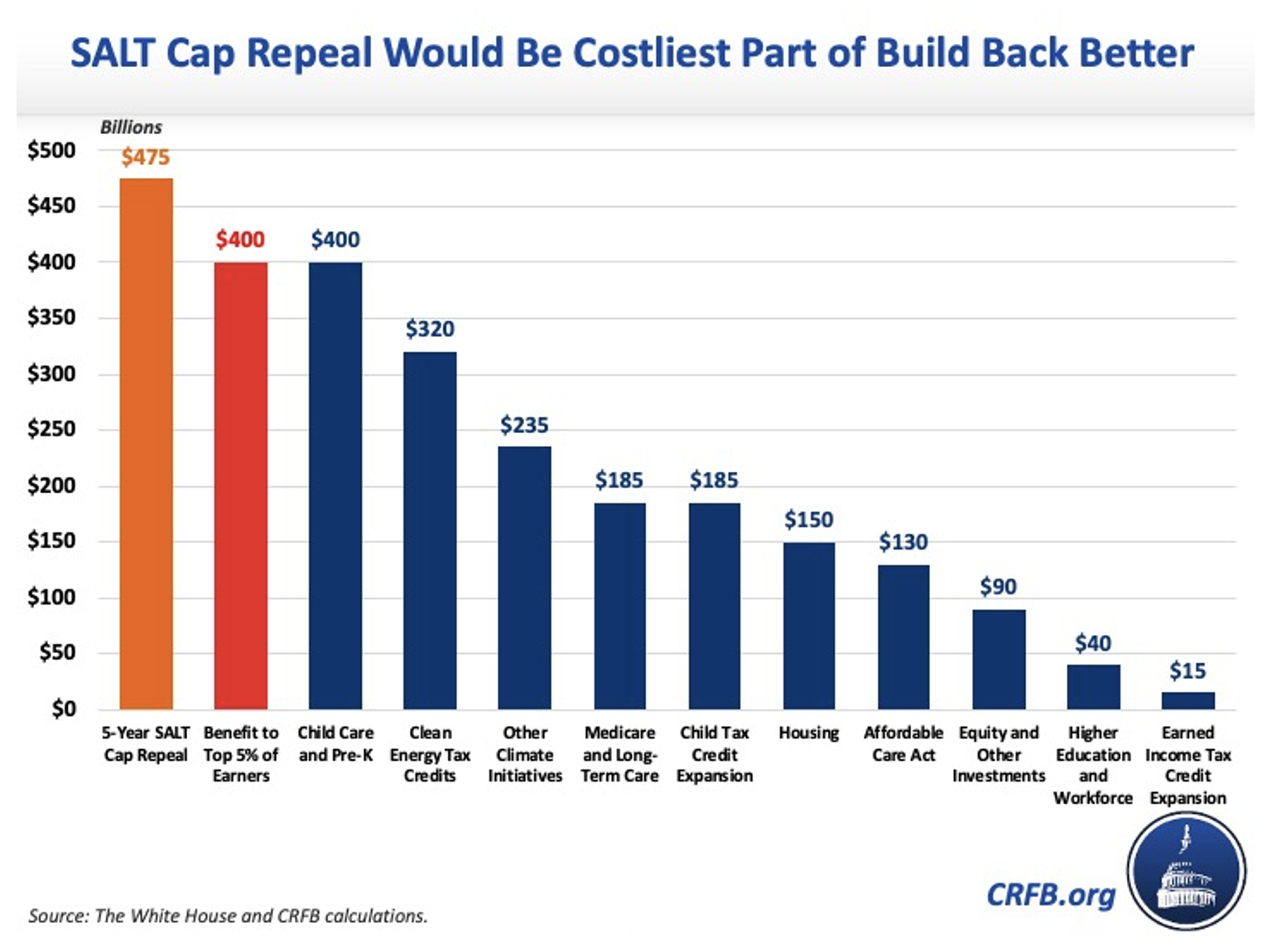

Repealing SALT would lower the. The SALT limit deduction brought in 774 billion during its first year according to the Joint Committee on Taxation and a full repeal for 2021 may cost up. Trump placed the 10000 cap on SALT deductions as part of his 2017 tax cut.

The push backed by Gov. 23 hours agoLaws in 27 states let owners circumvent the 10000 annual limit on state and local tax deductions in their federal tax filings with savings likely totaling at least 10 billion. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction.

Salt Tax Repeal New York. New York state on Monday made another attempt to overturn the 10000 cap on state and local tax deductions amid broader efforts in Congress to raise the ceiling and undo part of a 2017 tax law. Whats worse is that the law disproportionately hurts Democratic states like New York which already contributes 356 billion more annually to the federal government than it gets back.

Trumps 2017 tax cut capped the previously. 178 1 minute read. But for many democrats from high property tax states like new york repealing or altering the federal cap on deductions for state and local.

The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. Editor May 10 2021. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. 11 rows New York Taxpayers. New York Governor Andrew Cuomo said he expects the tax increases in his state budget deal to be offset by a repeal of the federal cap on state and local tax deductions.

Andrew Cuomos spin on the tax hikes in the state budget approved this month is this. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before reducing it back to. Kathy Hochul and Attorney General Letitia James was also supported by Connecticut Maryland and New Jersey similarly high-tax states where more.

Bidens DOJ is trying to preserve the. A bi-partisan group of county leaders from around the state joined with Congressman Tom Souzzi D-Long Island Queens and the New York State Association of Counties NYSAC on April 28 to call for an end to the cap on the deductibility of state and local taxes known as SALT. The SALT cap limits a persons deduction to 10000 for tax years beginning after December 31 2017 and before January 1 2026.

New York S Death Tax The Case For Killing It Empire Center For Public Policy Salt Tax Increase That Burned Blue.

Rep Steel Joins Colleagues To Launch Bipartisan Salt Caucus Representative Michelle Steel

Supreme Court Rejects Bid By Connecticut And New York To Repeal Salt Cap

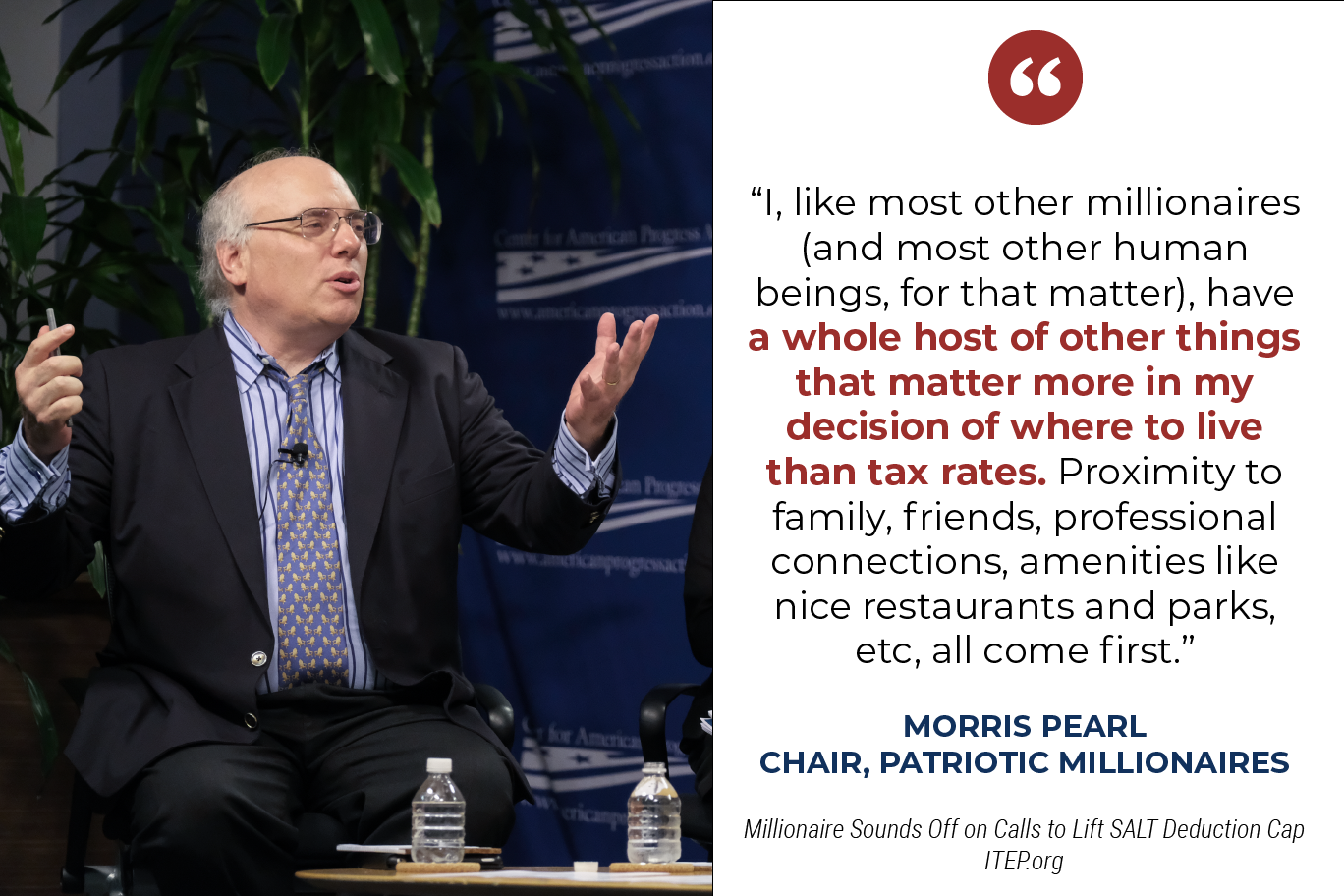

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

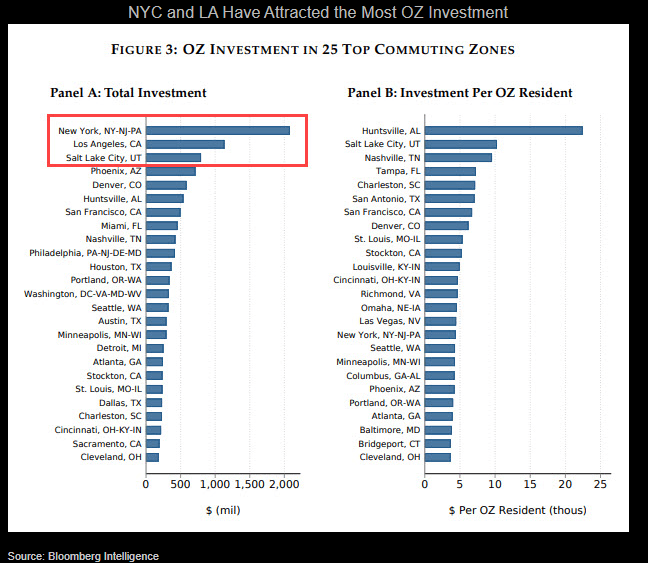

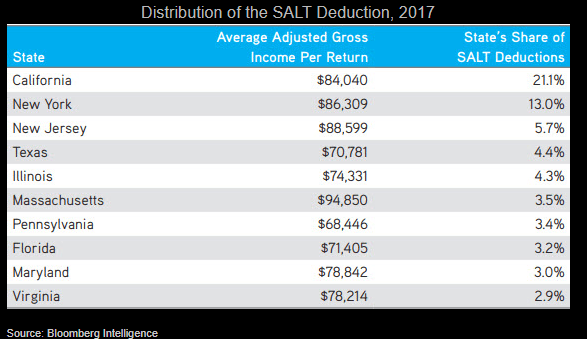

Salt Deduction Redux May Spark High End Spend Opportunity Funds Bloomberg Professional Services

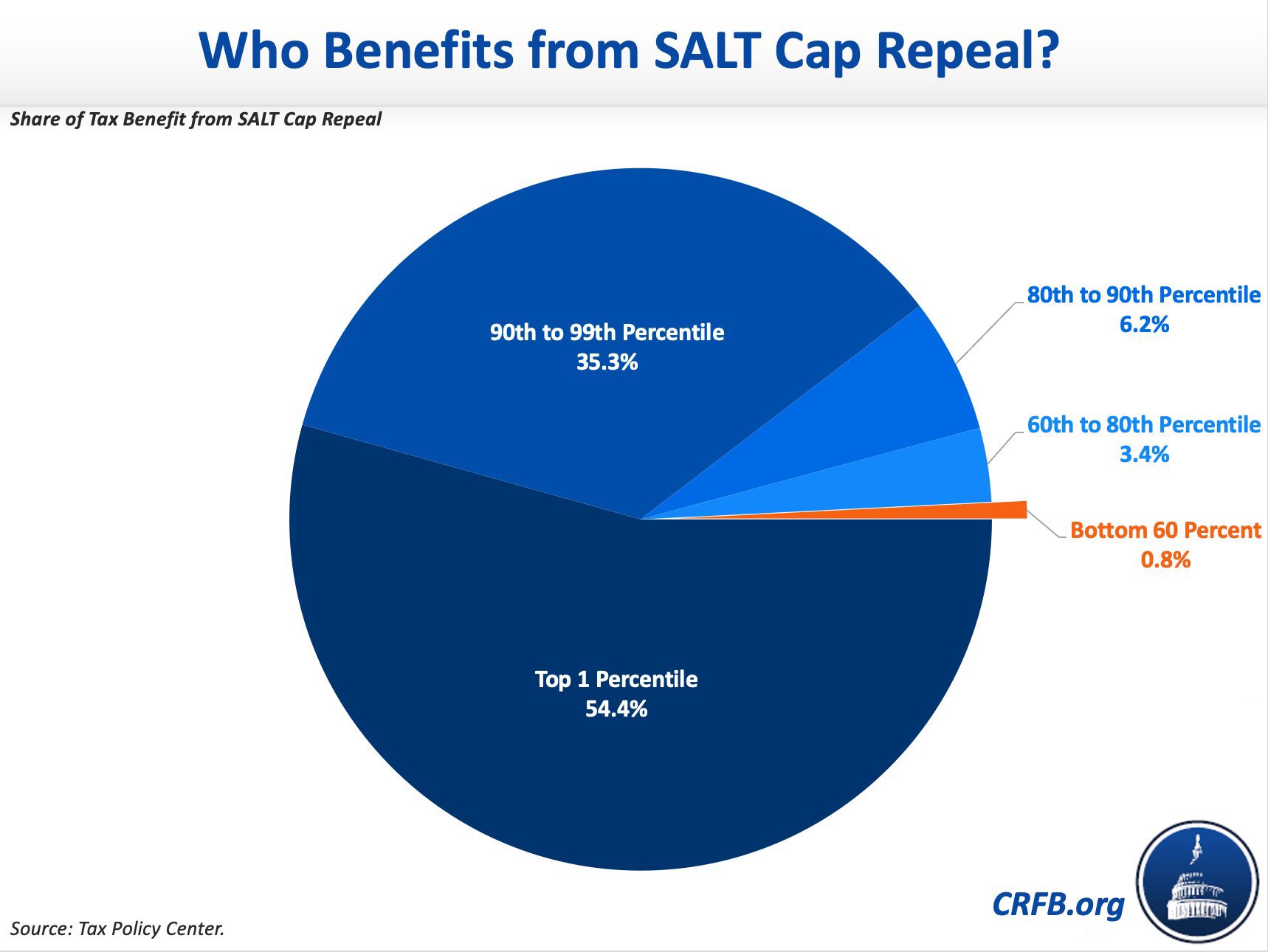

Salt Cap Repeal Would Worsen Racial Income And Wealth Divides Itep

Wealthy Americans May Get 10 Times Bigger Tax Cut Than Middle Class Families In Biden Bill

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

Salt Deduction Redux May Spark High End Spend Opportunity Funds Bloomberg Professional Services

Sanders Rips Pelosi Schumer For Backing Repeal Of Salt Cap

Moderate Dems Josh Gottheimer And Tom Suozzi Hold Out Hope For Salt Deduction This Year

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

Dems Hike Taxes On Middle Class To Pay For 475b Salt Tax Shelter For Rich Ways And Means Republicans

Congress And The Salt Deduction The Cpa Journal

Congress And The Salt Deduction The Cpa Journal

Saltcap Twitter Search Twitter

Congress And The Salt Deduction The Cpa Journal